|

|

1 - World Energy use, Efficiency & Wealth show one process |

|

(click the figures to enlarge images), ref's below |

|

|

1 - World Energy use, Efficiency & Wealth show one process |

|

(click the figures to enlarge images), ref's below |

It's almost intuitively obvious that how capable you are in using energy will be directly proportional to your wealth, and your ability to use more energy.

Energy is nature's universal resource. It's needed to turn anything into anything and makes nearly all other resources replaceable. For the world economy energy has also been easily moved around to where it would be used more productively. Figure 1 shows that the world economy does actually allocate its energy resources to make wealth and energy use grow rather smoothly. The world GDP and total energy use to produce wealth are visibly both part of the same smooth process. Even how much wealth is created per unit of energy, the economic efficiency and productivity of energy in creating GDP, also changes in constant proportion to the others .

You can even see how they're connected in the smaller details. The small scale waves in GDP roughly correspond to the small scale waves in energy use. If one looked at more detailed efficiency and energy curves you could see the waves in energy and efficiency trends being out of synch. Periods of faster energy use increase alternate with periods of faster efficiency improvement, seeming to correspond to recessions. It would be logical if pauses in growth were times when "creative destruction" in economies was eliminating inefficient processes so more efficient ones can then accelerate growth. Whatever the reason, it shows another level of consistent coordination in the money/energy relationship.

As people use it, money is just a number, and products are just a price. Both are detached from the energy and other things that physically deliver them. Using money can seem just a matter of trading scraps of paper, bidding up the price of things, buying low and selling high and all that, instead of as a right to a set share of the total physical work of the economy. The result is that the reality of where products come from and our information about their values is detached. That makes it possible for the value we see in money to spin out of control.

When people get their information only from other information, having no way to check, minds can wander and sometimes get quite lost.

|

|

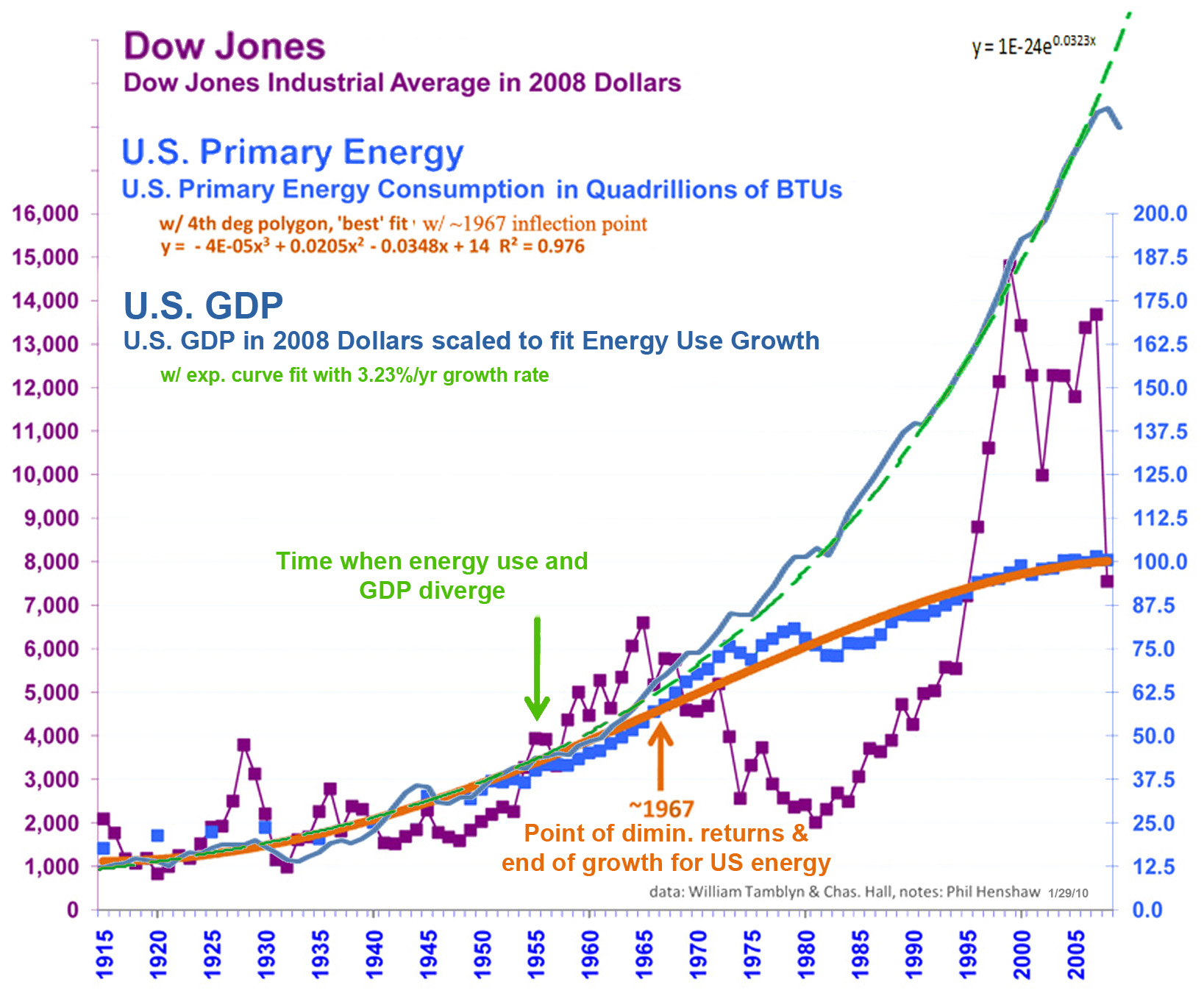

2 - US Energy use, Stock market & GDP showed diverging instability |

|

(tap your head to find the misinformation...) |

What this is about is also is the special debt to the world many readers of this article naturally have, having profited from the past decades of accumulating misinformation about our future. In some sense we need to give it back. We need to use our time wisely and give back value in proportion to the value we took. Now in hind sight we can see the windfall for how it was taken at the expense of others, particularly at the expense of our children, other cultures and the planet. The bubble was based on misinformation, used for short term profit, so the profits were not used well for sustainability. So our unstable economies are colliding with their natural limits completely unprepared to abruptly change to accommodate them. We have a special obligation to discover and help communicate how our world can get back to reality. The financial spree our whole world was on amounted to a grand Ponzi scheme, played on ourselves.

Those who profited from our global financial overshoot need to give it back somehow, to unwind the distortion, correct the misinformation, instead of continue to hold our crippled economy hostage to making good on the false promises it was saddled with in the past.

When people get their information from each other the only way the chains of retelling can stabilize is for some group to come to agreement on what to believe... Determining meanings by agreement, though, leaves only the agreement to verify itself. It seems you can see the effect of that in figure 2, with the stock market over the century wandering wildly, not seeming to follow in any way either the rather smooth changes in energy use or GDP.

How creating information by agreement can give group thinking functional fixations is apparent in the many kinds of misunderstanding and barriers to communication between cultures and religions. The same clash of languages shows it the strange walls between academic disciplines, even those studying the same subject. For example, ecology and economy study the same subject but their knowledge simply does not seem to overlap.

From the Greek word roots one is supposed to be "the logic of" and the other "the measure of" what the Greeks called "habitation". The two agree on many of the meanings of their own words, but there is almost no connection between the two languages. It seems they are widely thought to be in deep conflict, but that not widely thought to be important. You could say people often just "agree to disagree", or... that we often seem to just make up our own information.

Could it be just arriving at our information by agreement that does that?

Comparing figure 1 and 2 the question is why US energy use

started leveling off in the mid 60's instead as continuing to grow as global

energy use does matching GDP. It raises a variety of questions, but

it's clear where the world's energy investment was not going, to the US.

It appears the only reason investors would not have continued to invest in

energy using industry in the US was that it became unprofitable, demonstrating

the US economy reached it's energy productivity growth limit in ~1967.

US GDP growth continued though, eventually dropping sharply with the financial collapse of 2008. The signs of that approach seem to be the divergence of the energy and money curves and the wild meandering of the stock market. Perhaps making products with energy would be less profitable but more stable. The stock market, though, simply wanders all over the place, seemingly with no direction at all. Perhaps it's something like a "random walk", a "blind indicator", a trend that very largely just follows itself.

What occurred to me is that the one thing stock traders know for sure might be that they themselves don't know anything about where the market is going. So as they brag and bluster they are also craning their necks to look over the shoulder of someone who does know, they think, and peeking over the cubical wall to copy the bets of their neighbor...

Something of that kind seems evidently happening, and highly persistent, in how the stock market fails show any meaningful trend at all, except collapsing when the economy did for the financial system panic.

One thing that might have helped start the US economy's slide toward increasingly unstable finances was the limit to growth for the US energy economy that occurred in ~1967 (when regular increase by %'s ended). Limits to growth were a big issue at the time, and for that factor is definitely occurred. One part of the response was the idea to eliminate limits with more investment. In the mid 70's a financial plan to restore growth emerged that seemed to eventually lead to the extensive financial deregulation now so implicated in the collapse. It was a celebrated cause of the emerging neo-conservative Republican economists. The idea was called "supply side economics", that if investors could invest more, it would assure rapid growth. It actually may have, but not as intended, starting the self-perpetuating inflation of the bubble.

The irony for US investors is that the natural end of growth for the US energy economy seems to be what prompted the theory that more investment would keep that from ever happening.

Where investment in the lagging US economy actually did find bigger returns was in ever shorter lived and riskier things, bidding up the value of fixed assets like housing, moving US technology overseas to employ cheaper workers, and borrowing on the expectation that future earnings would continue to multiply indefinitely. It took on a life of its own, with each riskier and less sustainable strategy being taken as permission to go further. Following each other's examples everyone just kept going a little further on that path.

Computers and the information revolution have been a bonus in many ways, but they have also very importantly been the innovation that allowed, and the instrument of, the other three disastrous investment strategies. Using investment strategies that were too complicated to understand began in the 70's not the late 90's and the 00's. Computers could churn out very narrow margins and the wave of money churning in general, than business investing, was fostered by computer technology. It all seemed like a great miracle, though, if one took short term profits as a map of the future as the whole society actually did. One might also have looking at the curves showing how expectations were diverging from long term realities, like figure 2.

What actually followed, starting about 1980, was the twenty five year whole system financial bubble. As investments in energy productivity increasingly went to other countries, and the paying investments in the US increasingly went into inflating asset prices and borrowing against future asset inflation, a whole culture of doing less to make more developed. That kind of investment creates a spiral of misinformation that accumulates, the classic trap leading to financial panics that people throughout history have been caught by over and over.

Money was being "made". How it works is by reinvesting profits continually in what looks like a "sure bet" because everyone else is reinvesting their profits too. There were other realities pointing the opposite direction, of course, but people told each other that if you invested more you'd make more, but it was a mania not wealth. It seemed like the ideal market! Everyone was getting to bet in a "sure thing" in which they could reinvest their winnings to multiply their bets, letting them make ever more money without "doing" anything for it.

We all know "there is no free lunch" but where people seem to make an exception is for "ever multiplying free lunch". I joke, actually. I don't think that's exactly how the misunderstanding occurs. I think it really occurs because, well first that we don't ask where our information comes from. If you don't know where your information comes from that "inexplicable run of fabulous luck" is in fact one of nature's common signals for the beginning of things that are actually wonderful. People just don't know to tell the difference.

The trouble with another person's group misinformation, of course, is you can't tell them! Facts are not useful for changing anyone's system of beliefs.

Lots of people getting to this point in understanding the problem just give up. If basing information on agreement is dangerous partly because it's confidence we DO control, but have no basis for, part of the solution would be finding a basis in paying attention to things we do NOT control, like the natural world. Accumulating misinformation, in any case, seems to be a persistent "loose screw" in our reasoning, giving us a lot of freedom but perhaps also a maze of blind spots.

In figure 2 you can also see the decade long accumulative stock market overshoot that preceded the crash of 1929 and the great depression of the 1930's. The financial bubble of the 1920's was a one decade long period of run-away market inflation. Following the great depression the institutions and government responded vigorously, of course. They upgraded the regulatory systems for the whole economy to be much more stable. This time the run-away market that developed, seemingly in response to natural growth limits for the US economy, could continue before collapsing a little longer. This time we had a 25 year global spree of multiplying misinformation about real values, rather than just a ten year one, it seems...

When people aren't thinking about this "phone game effect" they'd just never suspect that the beliefs everyone agrees might have come from self-reinforcing misunderstandings, that no one actually checked. When other people, from other groups, have their own "other fixations", it can leave no room for discussion without some common reality to refer to and find common ground in. The hurdle it the need to "take a break" from your own comfortable interpretations to look at things in a fresh way, taking evidence over which you have no influence as a "tabula rasa" to discover the meanings of. Studying things over which you have no control, like "reality", is a matter of letting both simple and complex things simply tell their own story. That's not impossible, and quite enjoyable in fact, but quite hard to do. That's the frustration.

If this view of how people almost can't help but let their cultural agreements become bubbles of misinformation, giving you a better picture of the tangled in webs of natural relations we have become ensnared in, then I'm hopeful. Human cultures are our "Avatars" for navigating the planet. They package all our ideas, and define what's "real" for us. If they get easily lost in bubbles of misinformation if their own making we need to do something else.

One thing that seems clear is that we need to stop trying to increasingly interfere with and control nature. We really aren't in control of even ourselves. We don't yet understand why, in order to serve us, most things in nature need to be free of our control to take care of themselves. Discovering and rebuilding that relationship is the only way we'll survive, and where we should be putting our resources.

1) Fig. 1- lEA world data 1971-2006: Economic product (GDP in 2000$), Energy use (TPES in btu's) & Economic Energy Efficiency ($lbtu), each scaled to their relative growth rates and indexed to 1971 value; The "efficiency effect" is implicitly the result of improving 'know-how' in using energy to create what people will buy.

2) Fig. 2 - Historical US energy use in quads and Dow Jones prices adjusted to inflation by Charles Hall and Wm Tamblyn with trend curve for energy data, notes and historical US GDP curves from US BEA data added by P. Henshaw.

(text and figures may be occasionally updated.)